one year ago, the organization with the very pessimistic predictions.

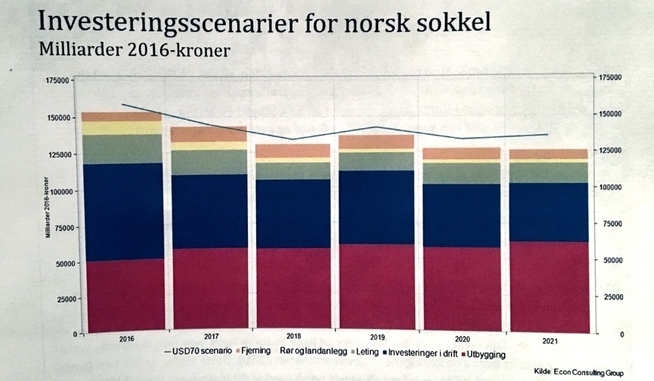

As predicted, the Norwegian oil and gas that petroleum investment would be 149 billion this year and reach a bottom 132 billion next year.

Now, they have adjusted the gloomy picture even more down, at least in the long term.

the Bottom is not reached until 2018, and the investment flattens out at a much lower level than recent years. It is hovedscenarioet in the organization’s konjunkturrapport, that will be presented in Oslo on Monday.

Fall to 131 billion.

petroleum investment will probably fall to 131 billion in 2018, says the Norwegian oil and gas, from an estimated 154 billion in the year.

the Organization adjusts up estimate of investments for 2017 to 143 billion. But the overall picture for the coming five-year period is darker than in the last year, when the organization saw a rise in investment towards the end of the decade.

– It can look dramatic on paper, ” says fagsjef of economics Bjørn Harald Martinsen in the Norwegian oil and gas to E24.

But one must also see that the projects we actually are now and to carry forward the next few years, has been significantly cheaper than the projects we conducted in the situation where the investment was over 200 billion a year, ” he says.

At the 2010 level

Now waiting the Norwegian oil and gas Norwegian oil investments will be around 130 billion between 2018 and 2021, given an oil price of 50 dollars a barrel.

It is equivalent in this case, a level in line with 2010, which is around 40 per cent lower than the level in the peak year of 2014.

this Image is not only negative, since a part of the fall in investments can be explained by the lower cost level in the industry, according to the Norwegian oil and gas.

“We get a lot more for the money now in the year than we did last year,” says Martinsen.

FALLS ON: the Norwegian oil and gas predicts that oljebremsen will continue through 2018, in the form of falling investment. In his konjunkturrapport predict the trade association that the investment will be around 130 billion in out 2021.

It means that many projects can be realized even if the investment level is much lower than in the toppårene forward to 2014.

– A reduced level of investment will not illustrate the number of projects on the Norwegian continental shelf, ” says Karl Eirik Schjødt-Pedersen, director for the Norwegian oil and gas.

Varies with the price of oil

Should the price of oil will be higher than estimated in the report, and lie at around 70 dollars a barrel instead of 50 dollars a barrel, will the investments, however, lie somewhat higher, but not much higher, according to the Norwegian oil and gas.

the Investments would then be around 140 billion a year between 2018 and 2021, estimates the organization.

– In our hovedscenario for investeringsutviklingen for the Norwegian continental shelf, which this time goes to 2021, we have assumed an oil price of 50 dollars per barrel as the basis for investment decisions, ” says Bjørn Harald Martinsen.

The second scenario is based on 70 dollars per barrel, ” he says.

An inventory from Statistics norway shows that the oil companies plan to spend around 169 billion in the year and nok 147 billion next year on exploration and extraction.

– Prisbunnen is reached

the Norwegian oil and gas believes that oil prices will not fall to the low levels from earlier in the year, at under 30 dollars a barrel. Members and non-members of the Opec cartel have declared that they will cut in production, which has lifted oil prices in recent weeks.

– the Bottom in oil prices appears to be passed. In the course of 2017 can one find the balance between supply and demand in the market, ” says Martinsen.

the Investments on the Norwegian continental shelf was on the whole 224 billion in the peak year of 2014. Prices have remained low much longer than many market participants had thought, and the oil companies have adjusted their investments sharply down.

These low oil prices have turned much more into your investments than you would think for just a couple of years ago, says Nordea Markets analyst Thina Saltvedt to E24.

Saltvedt is less optimistic than the Norwegian oil and gas when it comes to the activity on the Norwegian continental shelf in the coming years. She believes the oil companies will be cautious to initiate many new projects, despite somewhat higher prices in the past.

– There is no doubt: the Uk is a høykost-production country, ” says Saltvedt.

No comments:

Post a Comment